Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

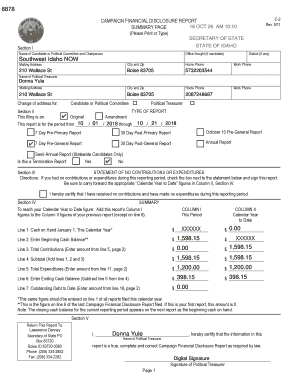

The term "year fiscal" refers to a financial year or fiscal year, which is a 12-month period used by organizations, businesses, and governments for accounting purposes. It is used to calculate and report financial activities, profits, and taxes. A fiscal year may or may not coincide with the calendar year and can vary depending on the entity's preferences or legal requirements.

Who is required to file year fiscal?

Typically, businesses and individuals who earn income in a fiscal year are required to file a year fiscal. This includes corporations, partnerships, sole proprietors, and individuals who meet certain income thresholds set by the tax authorities in their country. However, it is always best to consult with a tax professional or refer to the specific tax laws of your country for accurate and up-to-date information.

How to fill out year fiscal?

Filling out a fiscal year involves providing the necessary information about your organization's financial activities within a specific period. Here's a step-by-step guide to help you:

1. Determine the start and end dates of your fiscal year: The fiscal year can differ from the calendar year. Identify when your fiscal year starts and ends, as it will impact your financial reporting.

2. Gather financial statements: Collect all relevant financial documents, including balance sheets, income statements, cash flow reports, and any other necessary accounting records. These statements should cover the entire fiscal year.

3. Analyze financial transactions: Review all financial transactions that occurred during the fiscal year. This includes income received, expenses paid, assets purchased or sold, liabilities incurred or cleared, and any other financial activities. Ensure that your records are accurate and complete.

4. Prepare financial statements: Using the information from your financial records, generate essential financial statements. These commonly include an income statement (also known as a profit and loss statement), balance sheet, and cash flow statement. These statements provide a comprehensive overview of your organization's financial performance during the fiscal year.

5. Fill out the income statement: The income statement summarizes your organization's revenues and expenses over the fiscal year. It typically includes categories such as revenue, cost of goods sold, operating expenses, and net income or loss. Enter the corresponding amounts from your financial records into the appropriate categories.

6. Complete the balance sheet: The balance sheet presents your organization's assets, liabilities, and shareholders' equity at the end of the fiscal year. Categorize these items into sections such as current assets, non-current assets, current liabilities, long-term liabilities, and equity. Input the relevant amounts in each category.

7. Prepare the cash flow statement: The cash flow statement details the inflow and outflow of cash and measures your organization's cash position. Report cash from operating activities, investing activities, and financing activities. Ensure that all cash transactions are properly recorded and accounted for.

8. Review and reconcile the financial statements: Analyze the financial statements to ensure accuracy and consistency. Verify that the amounts align with your financial records and reflect the financial performance and position of your organization.

9. Seek professional advice if needed: If you're unsure about any aspect of filling out the fiscal year, consult with a professional accountant or financial advisor. They can provide guidance, ensure compliance with relevant regulations, and help address any uncertainties.

10. Retain copies and submit as required: Once you have filled out the fiscal year, retain copies of the financial statements for your records. Submit the necessary statements to relevant stakeholders, such as investors, regulatory bodies, or tax authorities, as per their requirements.

Remember that the process for filling out a fiscal year may vary depending on the specific regulations and reporting standards applicable to your organization. It's always advisable to follow the guidelines provided by the relevant authorities or seek professional assistance when needed.

What is the purpose of year fiscal?

The purpose of a fiscal year is to establish a consistent timeframe for financial reporting and budgeting. It is a 12-month period that companies, governments, and organizations use to track and evaluate their financial performance. The fiscal year may or may not align with the calendar year and is typically chosen based on convenience, industry norms, or legal requirements. By having a designated fiscal year, entities can maintain accurate financial records, compare performance over specific periods, make informed decisions based on financial data, and fulfill regulatory obligations.

What information must be reported on year fiscal?

The information that must be reported on a fiscal year includes:

1. Financial statements: This typically includes a balance sheet, income statement, statement of cash flows, and statement of changes in equity.

2. Revenue and expenses: The details of all revenue earned and expenses incurred by the company during the fiscal year.

3. Assets and liabilities: Information about the company's assets (such as cash, inventory, and property) and liabilities (such as loans, accounts payable, and accrued expenses).

4. Equity: The changes in the company's equity, including the issuance or repurchase of shares and any distributions to shareholders.

5. Notes to the financial statements: These provide additional explanations and disclosures about specific items in the financial statements, significant accounting policies followed, and any contingencies or subsequent events.

6. Management's discussion and analysis (MD&A): A narrative section where management provides an analysis of the financial results, significant trends, and future expectations.

7. Auditor's report: The opinion of an independent auditor on the fairness and accuracy of the financial statements.

8. Other required disclosures: Depending on the jurisdiction and industry, there may be additional mandatory disclosures, such as related party transactions, Segment reporting, or information about significant risks and uncertainties.

It's worth noting that the specific requirements may vary depending on the reporting framework or regulatory standards followed by the company, such as Generally Accepted Accounting Principles (GAAP), International Financial Reporting Standards (IFRS), or local regulatory guidelines.

When is the deadline to file year fiscal in 2023?

The deadline to file the fiscal year 2023 taxes will depend on the jurisdiction and the specific tax regulations of the country or state you are referring to. It is advisable to consult the relevant tax authority or a tax professional for accurate and up-to-date information regarding filing deadlines.

What is the penalty for the late filing of year fiscal?

The penalty for the late filing of a fiscal year can vary depending on the country and the specific regulations in place. In some jurisdictions, the penalty may be a fixed amount or a percentage of the taxes owed, while in others it may be a daily or monthly fine. Additionally, there may be interest charged on any outstanding tax liability resulting from the late filing. It is best to consult the tax laws and regulations of the respective jurisdiction for accurate and up-to-date information on penalties for late filing.

How can I send year fiscal to be eSigned by others?

When you're ready to share your allotment form pdf, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I sign the allotment form online electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your 2653 in minutes.

How do I edit allotment form download on an iOS device?

You certainly can. You can quickly edit, distribute, and sign allotment form on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.